Consequences of US National Debt Reaching $35 Trillion by 2024

The rising national debt, projected to reach $35 trillion by the end of 2024, could result in increased interest rates, reduced government spending on essential programs, a weakened US dollar, and a heavier financial burden on future generations.

The United States’ national debt is on track to hit a staggering $35 trillion by the close of 2024. It’s essential to understand what are the potential consequences of the rising national debt, projected to reach $35 trillion by the end of 2024, on future generations, and how it might impact our lives and the lives of generations to come. This article analyzes these potential impacts, offering insights into the complexities of this economic challenge.

Understanding the Scale of the National Debt

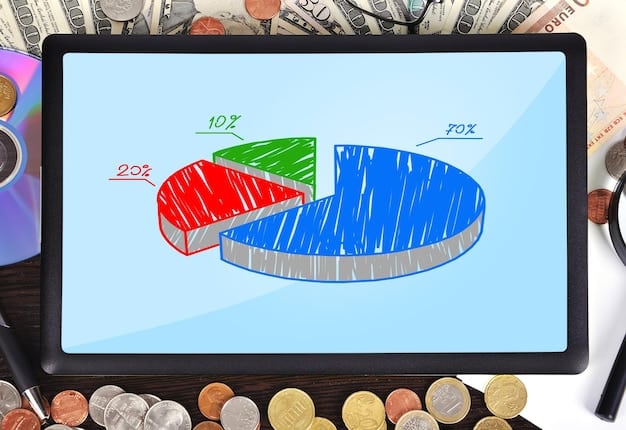

The sheer magnitude of a $35 trillion national debt can be difficult to grasp. It represents not just current government spending, but also accumulated deficits over many years. Understanding the scale is the first step in appreciating the potential consequences.

To put it in perspective, $35 trillion is more than the annual GDP of most countries in the world. This debt is the accumulation of years of government spending exceeding government revenue.

How Did We Get Here?

Several factors have contributed to the growth of the national debt, including tax cuts, increased spending on social programs, and military engagements. A combination of policy decisions and economic events has led to this point.

- Tax Cuts: Significant tax cuts, particularly those that were not offset by spending cuts, have reduced government revenues, increasing the need to borrow.

- Increased Spending: Increased spending on programs like Social Security, Medicare, and defense has outpaced revenue growth.

- Economic Downturns: Recessions and other economic downturns reduce tax revenues and often lead to increased government spending to stimulate the economy.

Understanding these factors provides context for the challenges that lie ahead. The debt affects everyone differently, and understanding its components is beneficial.

In conclusion, a $35 trillion national debt is an issue of significant proportion. Recognizing the scale allows us to better discuss the potential effects on future generations and explore possible solutions.

Impact on Future Economic Growth

One of the most significant concerns about the rising national debt is its potential drag on future economic growth. A high debt level can lead to higher interest rates, reduced investment, and decreased productivity.

When the government borrows heavily, it increases the demand for credit. This, in turn, can drive up interest rates. Understanding the interest rate impact is crucial.

The Crowding Out Effect

Government borrowing can “crowd out” private investment. This occurs when higher interest rates make it more expensive for businesses and individuals to borrow money, leading to reduced investment in new projects and ventures.

High levels of debt can also undermine confidence in the economy. Businesses may become hesitant to invest if they are concerned about the government’s ability to manage its debt. This hesitancy slows down growth. A struggling economy affects employment levels and overall quality of life.

- Reduced Investment: Higher interest rates can make it more expensive for businesses to invest in new capital projects.

- Decreased Productivity: Lower investment can lead to slower productivity growth.

- Slower Economic Growth: Overall, the crowding out effect can result in slower economic growth.

By understanding these components, we can begin to grasp the far-reaching consequences for those who will inherit this economy.

Increased Interest Rate Burdens

As the national debt increases, so does the amount of money the government must spend on interest payments. These payments divert funds from other important areas, such as education, infrastructure, and healthcare.

The more the government borrows, the higher the interest rates it may have to pay to attract investors. Interest rates are critical. Higher rates contribute to a cost spiral.

The Cycle of Debt

When a larger portion of the budget is dedicated to interest payments, less money is available for public services and investments. This can create a cycle of debt, where the government must borrow more to cover its existing obligations.

This cycle not only affects present government functions but also has long-term implications for future fiscal capacity and the services available to future generations. It can set the stage for perpetual budget cuts and fiscal instability. Without proper investment, a domino effect can be experienced within the country.

- Reduced Funding: Higher interest payments take away from funds available for other priorities.

- Limited Investments: Vital public services and investments suffer.

- Cycle of Debt: Creates a dangerous spiral needing more borrowing.

This has serious implications for future generations, who may face reduced government services and higher taxes to pay down the debt.

Impact on Social Security and Medicare

The rising national debt poses a significant threat to the long-term solvency of Social Security and Medicare, two of the most important social programs in the United States. The pressure to reduce government spending may lead to cuts in these programs.

These social programs impact millions of Americans, particularly the elderly and those with disabilities. Any substantial changes could have far-reaching consequences. Protecting these programs is crucial.

Potential Cuts and Reforms

To address the growing national debt, policymakers may consider reforms to Social Security and Medicare. Some potential changes include raising the retirement age, reducing benefits, and increasing taxes. These changes can impact retirees.

Such reforms, while perhaps necessary from a fiscal standpoint, will inevitably affect the benefits received by current and future retirees. It prompts crucial discussions about the responsibilities to current and future generations. These programs should continue providing for all Americans in need.

- Raising Retirement Age: A higher retirement age could reduce the number of years people receive Social Security benefits.

- Reducing Benefits: Benefit reductions would decrease the amount of money retirees receive each month.

- Increasing Taxes: Higher taxes could help shore up the programs’ finances but would also reduce disposable income for workers.

In conclusion, a high national debt can force difficult choices about the future of these programs, impacting the financial security of future generations.

Decline in Global Competitiveness

A high national debt can undermine a nation’s global competitiveness. It can lead to a weaker currency, reduced investment, and decreased innovation. Governments must monitor debt responsibly. It helps with global competitiveness.

When investors lose confidence in a country’s ability to manage its debt, they may demand higher returns on their investments or choose to invest elsewhere. This can lead to capital flight and a weaker currency. Currency stability matters.

The Impact on Trade

A weaker currency can make a country’s exports cheaper, but it also makes imports more expensive. This can lead to trade imbalances and reduce the purchasing power of consumers.

Moreover, the need to service a large national debt can divert resources from investments in infrastructure, education, and research and development, all of which are essential for maintaining a competitive edge in the global marketplace. There is a need to keep investing.

- Weaker Currency: Investors may lose confidence and demand higher returns.

- Reduced Investment: Can lead to capital flight.

- Trade Imbalances: Can make imports more expensive.

In time, a high national debt can erode a country’s economic standing and reduce its influence on the world stage.

Political and Social Instability

While often overlooked, the economic effects of the national debt can translate into political and social unrest. As government services decline and economic opportunities shrink, it can lead to widespread frustration and instability.

A high national debt can limit the government’s ability to respond to crises, whether they are economic downturns, natural disasters, or public health emergencies. Limited funding is not beneficial.

Erosion of Public Trust

When people feel that the government is not managing its finances responsibly, it can erode public trust and lead to political polarization. This can make it more difficult to address the underlying problems and find common ground.

Furthermore, the burden of a high national debt can exacerbate social inequalities, as the wealthy are often better positioned to weather economic storms than the poor and middle class. Trust is important in government.

- Limited Crisis Response: Difficult to respond to economic downturns

- Erosion of Trust: When people feel the government isn’t responsible

- Social Inequalities: The wealthy are often better positioned to weather economic storms

This instability has broad implications for future generations and our social fabric.

Strategies for Addressing the National Debt

Addressing the rising national debt requires a combination of fiscal discipline, economic growth, and responsible policymaking. There is a need to address this issue.

One approach is to reduce government spending. This can be achieved through measures such as cutting wasteful programs, streamlining government operations, and reforming entitlement programs. Consider some cost-cutting strategies.

Tax Reforms

Another approach is to increase government revenues. This can be accomplished through tax reforms, such as closing tax loopholes, raising tax rates on high earners, and implementing a carbon tax. Raising revenue is important.

Ultimately, addressing the national debt requires a willingness to make difficult choices and a commitment to long-term fiscal responsibility. Balancing all perspectives is crucial.

- Reduce Spending: Achieved through cutting programs.

- Tax Reforms: Such as closing tax loopholes.

- Fiscal Responsibility: A commitment to long-term stability.

The strategies are viable provided the government is willing to work together.

| Key Point | Brief Description |

|---|---|

| 💸 Economic Growth | High debt can reduce investment and productivity. |

| 📊 Interest Rates | Increased debt leads to higher interest payments. |

| 🛡️ Social Programs | Threatens solvency of Social Security and Medicare. |

| 🌍 Competitiveness | Undermines global competitiveness and currency strength. |

Frequently Asked Questions

▼

The national debt is the total amount of money that the U.S. federal government owes to its creditors. It’s accumulated over time through budget deficits, when the government spends more than it collects in revenue.

▼

A high national debt can lead to higher taxes in the future. To manage the debt, the government may need to increase taxes to generate more revenue, reducing disposable income for individuals and businesses.

▼

Potential solutions include reducing government spending, increasing taxes, and implementing policies that promote economic growth. A balanced approach is often considered the most effective strategy.

▼

The national debt can threaten the long-term solvency of Social Security and Medicare. Policymakers may consider reforms such as raising the retirement age or reducing benefits to address the debt.

▼

While high debt levels have drawbacks, responsible borrowing can finance investments that boost long-term economic growth. The key is to balance borrowing with prudent fiscal management for economic health.

Conclusion

In conclusion, the projected rise of the national debt to $35 trillion by the end of 2024 poses significant challenges for future generations. From slower economic growth and increased interest burdens to threats to Social Security and Medicare, the consequences are far-reaching and demand responsible policymaking and fiscal discipline to ensure a stable and prosperous future for all.