Major Bank Cyber Breach: What 2 Million Customers Need to Know

A major cybersecurity breach at a national bank has compromised the data of 2 million customers. This incident raises serious concerns about data security and highlights the importance of understanding the potential consequences and necessary steps to protect personal information.

A concerning situation has unfolded as a major cybersecurity breach at a national bank has exposed the sensitive data of 2 million customers. The gravity of this incident cannot be overstated, as it presents significant risks to those affected. Let’s delve into the details of the breach, what information may have been compromised, and, most importantly, what you can do to protect yourself.

Understanding the Cybersecurity Breach at National Bank

The recent cybersecurity breach at National Bank has sent shockwaves through the financial industry and left millions of customers vulnerable. It’s crucial to understand the scope and nature of the attack to assess the potential impact.

The breach occurred through a sophisticated phishing campaign. Cybercriminals targeted bank employees with emails designed to appear legitimate, leading them to inadvertently disclose sensitive login credentials. These credentials were then used to access the bank’s internal systems and exfiltrate customer data.

The Anatomy of the Attack

Understanding how the attack unfolded helps illustrate the vulnerabilities that exist within even large financial institutions:

- Initial Phishing Campaign: The attackers initiated a targeted phishing campaign aimed at bank employees. These emails were crafted to appear as legitimate communications from internal sources or trusted third parties.

- Credential Compromise: Unsuspecting employees clicked on malicious links and entered their login credentials on fake websites, unknowingly handing over access to cybercriminals.

- System Intrusion: Using the stolen credentials, attackers gained unauthorized access to the bank’s internal systems, navigating through various departments and databases.

- Data Exfiltration: The attackers extracted sensitive customer data, including personal details, account numbers, and potentially even credit card information.

The investigation revealed that the attackers remained undetected within the bank’s systems for several weeks, allowing them ample time to gather and exfiltrate a significant amount of data. This highlights the importance of robust security protocols and early detection systems.

What Data Was Compromised?

One of the biggest concerns following a data breach is understanding what specific information was compromised. In the case of National Bank, the following types of data were potentially exposed:

- Personal Information: Names, addresses, dates of birth, Social Security numbers, and other identifying details.

- Account Information: Account numbers, transaction histories, and bank balances.

- Login Credentials: Usernames and passwords used to access online banking platforms.

- Credit Card Information: Credit card numbers, expiration dates, and CVV codes for some customers.

The potential exposure of this information can lead to various forms of identity theft and financial fraud. Customers whose data was compromised are at risk of having their accounts accessed, credit cards used fraudulently, and personal information used for malicious purposes.

The bank has notified affected customers to change their passwords and monitor their accounts for any suspicious activity. However, the long-term impact of the breach remains a significant concern.

Immediate Steps for Affected Customers

If you are a customer of National Bank, it’s crucial to take immediate steps to protect yourself from potential harm. These steps will help mitigate the risks associated with the data breach:

Change Your Passwords

Immediately change your passwords for all online banking accounts and any other accounts that may use the same username and password combination. Choose strong, unique passwords that are difficult to guess.

Monitor Your Accounts

Closely monitor your bank accounts, credit card statements, and credit reports for any signs of suspicious activity. Report any unauthorized transactions or discrepancies to your bank and credit card companies immediately.

Place a Fraud Alert

Consider placing a fraud alert on your credit report. This will alert creditors to take extra steps to verify your identity before issuing credit in your name.

Enroll in Credit Monitoring

Enroll in a credit monitoring service to receive alerts when changes are made to your credit report. This can help you detect and address any potential identity theft issues early on.

Taking these immediate steps can significantly reduce your risk of becoming a victim of identity theft or financial fraud following the National Bank data breach. Stay vigilant and proactive in protecting your personal information.

Long-Term Protection Strategies

While immediate actions are essential, it’s also important to adopt long-term strategies to protect your personal information from future data breaches and cyber threats. Consider implementing the following measures:

- Use Strong, Unique Passwords: Avoid using the same password for multiple accounts. Use a password manager to generate and store strong, unique passwords.

- Enable Two-Factor Authentication: Whenever possible, enable two-factor authentication (2FA) for your online accounts. This adds an extra layer of security by requiring a second verification method, such as a code sent to your phone.

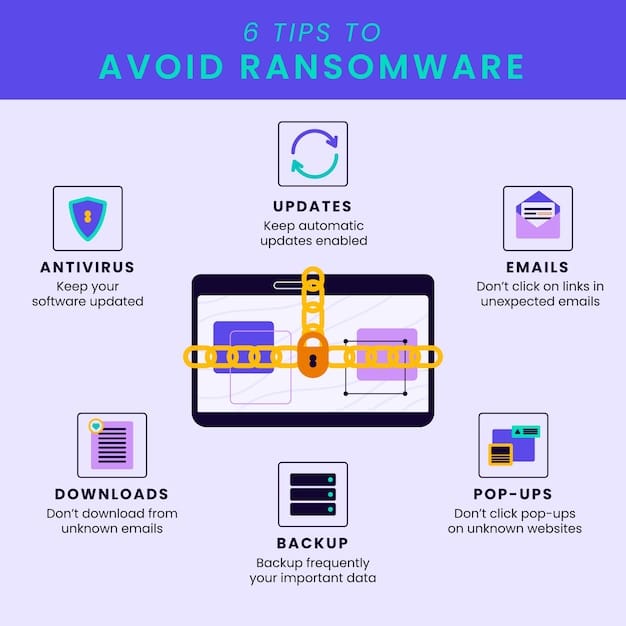

- Be Wary of Phishing Emails: Be cautious of suspicious emails and avoid clicking on links or opening attachments from unknown senders.

- Keep Software Updated: Regularly update your computer’s operating system, antivirus software, and other applications to patch security vulnerabilities.

By adopting these long-term protection strategies, you can significantly reduce your risk of falling victim to future cyberattacks and data breaches. Staying informed and proactive is crucial in today’s digital landscape.

The Bank’s Response and Future Security Measures

In the aftermath of the cybersecurity breach, National Bank has taken steps to address the incident and implement enhanced security measures. Here’s an overview of their response and future plans:

Immediate Actions

The bank immediately launched an investigation to determine the scope of the breach and identify the attackers. They also notified law enforcement and regulatory agencies.

National Bank has offered free credit monitoring services to affected customers and provided guidance on how to protect their personal information.

Enhanced Security Measures

The bank is investing in enhanced security measures to prevent future breaches, including:

- Strengthened Employee Training: Implementing more robust training programs to educate employees about phishing scams and other cyber threats.

- Advanced Threat Detection: Deploying advanced threat detection systems to identify and respond to suspicious activity in real-time.

- Enhanced Encryption: Improving encryption protocols to protect sensitive data both in transit and at rest.

These measures are designed to enhance the bank’s overall security posture and prevent future data breaches. Customers are encouraged to stay informed about the bank’s security efforts and continue to take proactive steps to protect their personal information.

National Bank is committed to regaining the trust of its customers and ensuring the security of their data. The road to recovery will be long, but these steps are essential to building a more secure future.

| Key Point | Brief Description |

|---|---|

| 🚨 Breach Alert | National Bank data breach affects 2 million customers. |

| 🔒 Data Exposed | Personal, account, and potentially credit card info compromised. |

| 🛡️ Immediate Action | Change passwords, monitor accounts, and place fraud alerts. |

| 🏦 Bank Response | Enhanced security, employee training, and customer support offered. |

Frequently Asked Questions

▼

A significant cyberattack targeted National Bank, compromising the data of approximately 2 million customers. This breach was the result of a sophisticated phishing campaign where cybercriminals gained unauthorized access.

▼

The compromised data included personal information like names and addresses, account details, login credentials, and, for some customers, credit card information. This puts affected individuals at risk of identity theft.

▼

Customers should immediately change their passwords for all online banking accounts and related services. They should also monitor accounts for suspicious activity and consider placing a fraud alert on their credit report.

▼

National Bank is offering free credit monitoring, enhancing their security measures, and improving employee training to prevent future incidents. They are also working with law enforcement to investigate the breach.

▼

Long-term protection includes using strong, unique passwords, enabling two-factor authentication, being cautious of phishing emails, and keeping software updated. These practices can significantly reduce vulnerability to cyber threats.

Conclusion

The recent cybersecurity breach at National Bank serves as a stark reminder of the ever-present threat of cybercrime in our digital age. The compromise of sensitive data affecting millions underscores the importance of robust security measures, proactive customer vigilance, and swift responses from financial institutions. By taking immediate steps to protect personal information and adopting long-term security strategies, individuals can mitigate their risk and contribute to a more secure online environment.