Insights on banking app features 2025: what to expect

Integrating AI in banking apps enhances personalized user experiences through tailored financial advice, while emphasizing security measures like multi-factor authentication to protect sensitive information.

Insights on banking app features 2025 offer a glimpse into the evolving landscape of financial technology. Have you ever wondered how these features can simplify your daily transactions and enhance your banking experience?

Key trends shaping banking apps in 2025

In 2025, banking apps will continue to evolve, driven by the demand for enhanced user experience and innovative features. Key trends shaping banking apps will bring significant changes that cater to customer needs.

One of the major trends is the integration of advanced artificial intelligence. This technology will allow banks to offer personalized services, understanding customer preferences and behavior in real-time.

Seamless User Experience

Another focus will be on creating a seamless user experience. Simplicity and efficiency are crucial. Customers want to manage their finances quickly and easily.

- Intuitive interfaces that require minimal navigation

- Quick transaction processes with fewer steps

- Enhanced accessibility for users of all skill levels

Moreover, enhanced security measures will become a top priority. As digital banking grows, customers are more concerned about their data safety.

Importance of Security

Institutions will focus on multilayered security systems, ensuring user trust is maintained. Features like biometric logins and two-factor authentication are expected to be standard.

- Real-time fraud monitoring systems

- Data encryption for transactions

- Regular security updates and notifications

Additionally, the shift towards sustainability will influence banking app features. Banks will increasingly promote green initiatives, allowing users to track their carbon footprint and invest sustainably.

Apps will display total emissions from spending, focusing on transparency in financial choices. Feature integration will encourage users to engage with eco-friendly options.

As we look ahead, understanding these key trends will be essential for users seeking the most efficient banking experience. Overall, the banking apps of 2025 will blend convenience, security, and sustainability, meeting the expectations of modern customers.

Must-have features for user-friendly banking apps

In today’s fast-paced world, user-friendly banking apps are essential for managing finances efficiently. Users demand apps that are not only functional but also intuitive and easy to navigate.

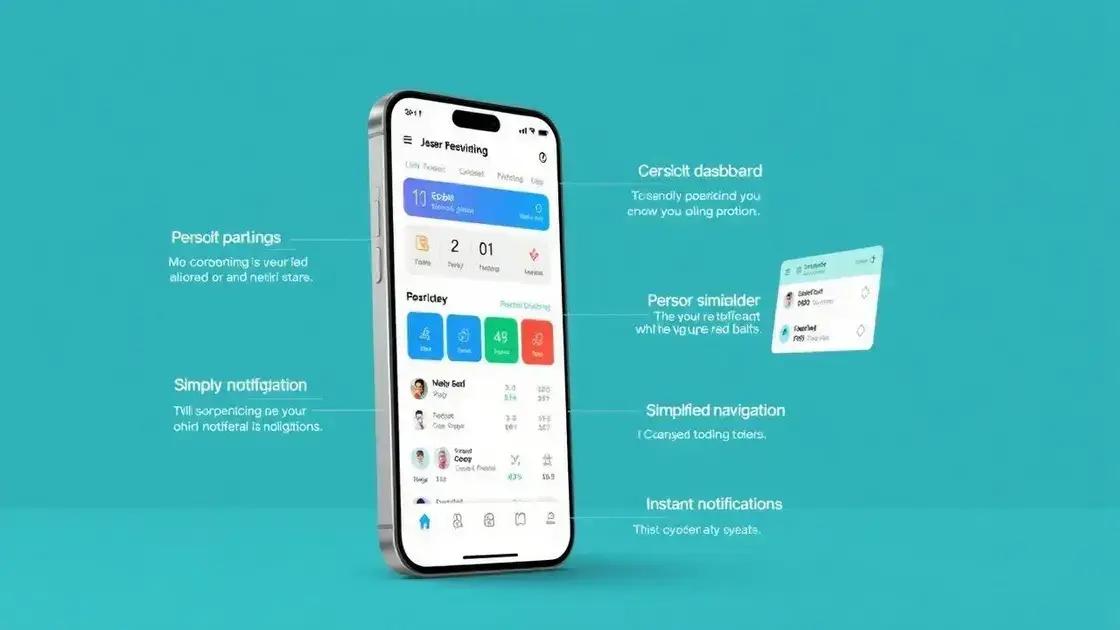

A top feature users look for is personalized dashboards. These allow customers to see key information at a glance, such as account balances and recent transactions. It gives them a sense of control over their finances.

Simplified Navigation

Another important characteristic is simplified navigation. Users appreciate when they can find what they need quickly. Less clutter and straightforward menus help users get their tasks done with minimal effort.

- Clear labeling of icons and sections

- A minimal number of steps to complete transactions

- Quick access to frequently used features

Moreover, integrating multi-channel support adds significant value. Customers should have the option to reach out for help through different channels like chat, phone, or email.

Instant Notifications

Instant notifications are another must-have feature that keeps users informed about their finances. These alerts can range from transaction confirmations to reminders about upcoming payments.

- Real-time transaction alerts

- Budget reminders to avoid overdrafts

- Alerts for suspicious activity on their account

Furthermore, security features cannot be overlooked. Users need to feel safe while banking online, so biometric authentication, such as fingerprints or facial recognition, is growing in popularity.

Another crucial aspect is education within the app. Providing resources like financial advice and budgeting tips enhances the user experience. This proactive approach helps empower users to make informed financial decisions.

By implementing these must-have features, banking apps can significantly enhance user experience, ensuring that customers not only use the app but trust it for their financial needs.

The role of security in future banking applications

As banking moves further into the digital realm, the role of security in future banking applications becomes increasingly critical. Users expect their financial data to be protected at all costs, and banks need to deliver on those expectations.

One of the most significant aspects of app security is encryption. Encryption ensures that data transmitted between the app and the bank remains private and secure, protecting sensitive information from cyber threats.

Multi-Factor Authentication

Another essential feature is multi-factor authentication (MFA). This adds an extra layer of security beyond just a password. Users will be required to verify their identity in multiple ways, which significantly enhances account protection.

- Access codes sent via SMS or email

- Biometric verification, such as fingerprints or facial recognition

- Security questions that are hard to guess

Furthermore, banks will invest in advanced fraud detection systems. These systems will use machine learning algorithms to identify suspicious activities in real time, alerting users and preventing potential fraud before it happens.

Regular Security Updates

Banks will also prioritize regular security updates. Frequent updates help patch vulnerabilities, ensuring that banking apps stay robust against new threats. Users should be encouraged to download updates promptly to benefit from these enhancements.

- Automated notifications for available updates

- Education on the importance of updates

- Transparent communication regarding updates and security features

Moreover, users will increasingly demand transparency from their banks. Clear communication about security practices and protocols helps build trust and encourages users to engage more confidently with banking apps.

In addition to these features, banks might also adopt blockchain technology for secure transaction recording. This decentralized approach can provide additional layers of trust and verification, making transactions even more secure.

In summary, the evolving landscape of banking applications requires a strong focus on security. As new threats emerge, ensuring robust security measures will be vital to retain user trust and confidence in digital banking.

Integrating AI for personalized banking experiences

Integrating AI into banking applications is transforming how users experience their finances. By leveraging technology, banks can create more personalized banking experiences that cater to individual needs.

One of the most significant benefits of AI in banking is its ability to analyze customer data. This allows banks to offer tailored recommendations, ensuring users receive relevant financial advice based on their spending habits and goals.

Smart Chatbots

AI-driven chatbots are becoming essential tools for customer service. These chatbots can provide instant responses to user inquiries, guiding them through various banking processes.

- 24/7 support for customer inquiries

- Personalized interactions based on user history

- Handling basic transactions without human intervention

Moreover, AI can enhance fraud detection. By monitoring transactions and identifying unusual activity, artificial intelligence helps protect users from fraudulent actions. This proactive approach ensures that potential issues are addressed before they become significant problems.

Customized Financial Products

Another area where AI excels is in offering customized financial products. Based on data analysis, banks can suggest credit cards, loans, or savings accounts that align with a user’s financial profile.

- Personalized loan rates based on credit history

- Custom savings plans to meet individual goals

- Targeted promotions for products relevant to users

Additionally, AI can support users in budgeting and expense tracking. By analyzing spending patterns, AI tools can offer insights and tips on how to save money or manage expenses effectively.

As the technology continues to improve, we can expect more banks to adopt AI to refine the user experience. The goal is to create a more seamless, intuitive process for managing finances. By prioritizing personalization, banks can foster stronger relationships with their customers.

In summary, the future of banking apps is bright as they become increasingly user-friendly and secure. Key trends include personalized experiences through AI, enhanced security measures, and streamlined interfaces. As banks continue to innovate, they will focus on meeting customer needs by providing seamless and efficient services. Staying aware of these developments will empower users to make informed decisions about their finances.

FAQ – Frequently Asked Questions about Banking App Features

How does AI improve personalized banking experiences?

AI analyzes user data to offer tailored financial advice and product recommendations, making banking more relevant to each user’s needs.

What security measures should I expect in future banking apps?

Future banking apps will likely include strong security features such as multi-factor authentication and real-time fraud detection systems.

Why are user-friendly designs important in banking apps?

User-friendly designs enhance customer satisfaction by making navigation simple and efficient, allowing users to manage their finances effortlessly.

How do banking apps keep users informed about their accounts?

Banking apps use instant notifications to alert users about transactions, reminders, and potentially fraudulent activities to keep them informed.